4 Tips for Effectively Making an Offer

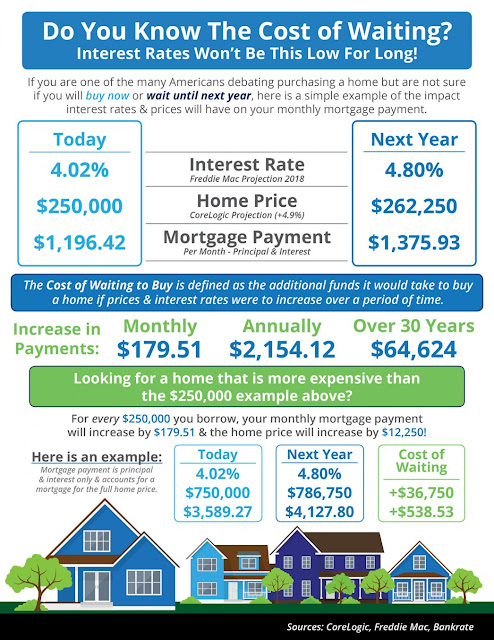

So, you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market, you want to make sure that you make a good offer so that you can guarantee that your dream of making this house yours comes true! Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 tips they covered along with some additional information for your consideration: 1. Understand How Much You Can Afford “While it's not nearly as fun as house hunting, fully understanding your finances is critical in making an offer.” This ‘tip’ or ‘step’ should really take place before you start your home search process. As we’ve mentioned before , getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mo